ESG as the Growth Engine for SMEs

The SME Johor Selatan ESG Engagement Session 2025 was held on 2 December in Johor Bahru at the Setia Convention Centre, Setia Tropika. Organized in partnership with the Malaysian Investment Development Authority (MIDA), the conference explored how SMEs can manage business risks while integrating ESG practices in a competitive and regulated environment.

The conference focused on turning ESG from a theoretical concept into concrete action. Participants gained exposure to frameworks, tools, and real-world SME case studies that demonstrated how sustainability can shape stronger business performance. The message was clear: delayed ESG adoption exposes SMEs to regulatory, reputational, and financial risks. Timely action, however, strengthens operations, enhances market positioning, and unlocks long-term growth.

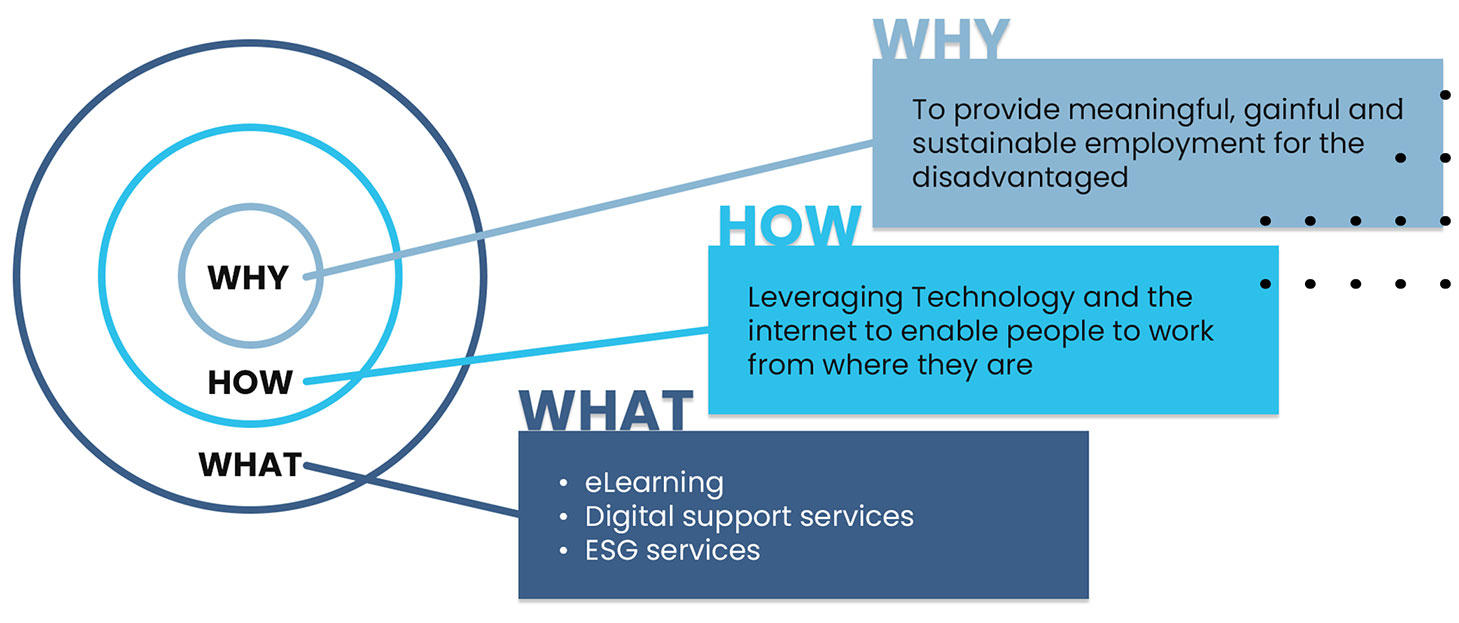

Genashtim’s Head of ESG Services and B Market Builder SEA Director, Ee Bang Tan, was one of the key speakers. He highlighted that ESG presents both a potential business risk and a strategic opportunity. Rather than treating it as a compliance exercise, he encouraged SMEs to recognize ESG as a lever for business expansion. Ee Bang also introduced the B Impact Assessment, which is a free, global benchmarking tool that helps SMEs identify gaps, prioritize improvements, and build credibility with investors, customers, and international partners. The tool also provides a structured pathway toward B Corp certification.

The session gathered experts from finance, government, and industry, who shared practical insights and actionable strategies that SMEs can adopt to implement ESG effectively:

- Mr. Ma of Alliance Bank Malaysia shared how the bank integrates ESG into lending and advisory services to strengthen SME resilience.

- Mr. Syed Kamal Muzaffa from MIDA highlighted government incentives and frameworks to support faster ESG adoption across the SME sector.

- Mr. Kian Seah of Heng Hiap Industries shared insights into the business advantages gained from B Corp certification and MIDA grants, including access to new market.

- Mr. Masaaki Hamada of Asuene APAC introduced digital tools that help SMEs track emissions and reduce their carbon footprint.

- Ms. Sun of SUNLEE Insurance discussed ways SMEs can mitigate ESG-related risk through tailored insurance solutions.

Together, the speakers provided SMEs with actionable guidance on integrating ESG into operations, managing risks, and unlocking growth opportunities.

Genashtim is honored to have participated in the event that reflects the rising momentum of ESG adoption among Malaysian SMEs. The session reinforced how ESG can serve as a strategic lever for tangible growth, helping SMEs attract partners, enter new markets, and make operational decisions with measurable impact. With the right tools and a clear roadmap, sustainability becomes a driver for expansion and credibility rather than a compliance obligation.